Get the free form 84ag refund table - revenue ne

Show details

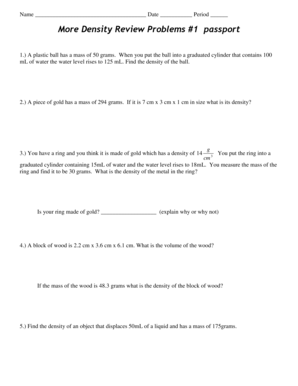

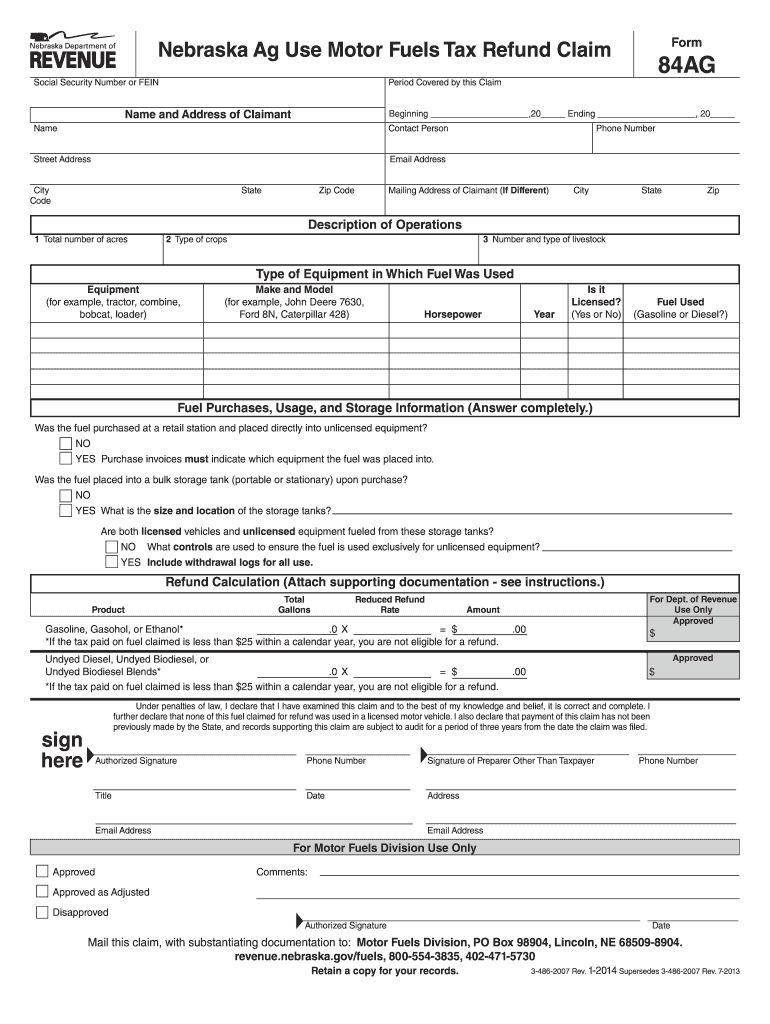

Any person requesting a refund of Nebraska motor fuels tax paid on fuel used in unlicensed equipment for farming or ranching purposes may file a Nebraska Ag Use Motor Fuels Tax Refund Claim Form 84AG. Prior to adjustments the tax paid on the eligible fuel must be at least 25. If the fuel was placed directly into unlicensed equipment the equipment fueled must be indicated on the invoice and which the fuel was placed if both licensed vehicles and u...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 84ag refund table

Edit your form 84ag refund table form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 84ag refund table form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 84ag refund table online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 84ag refund table. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 84ag refund table

How to Fill Out Form 84ag Refund Table:

01

Firstly, gather all the necessary information and documents required for the refund calculation. This may include previous tax returns, receipts, and any relevant financial records.

02

Next, carefully review the instructions provided with Form 84ag to ensure that you understand the requirements and guidelines for filling out the refund table accurately.

03

Begin by entering your personal information, such as your name, address, and Social Security number, in the designated fields on the form.

04

Proceed to the refund table section of the form. Here, you will need to input the necessary information to calculate your refund. This typically includes details about your income, deductions, exemptions, and any applicable credits or payments.

05

Write down the relevant figures in the corresponding columns and rows of the refund table, making sure to accurately calculate and enter each amount.

06

Double-check all the entries and calculations to ensure accuracy. Any errors or discrepancies could result in an incorrect refund amount.

07

Once you have completed the refund table, carefully review the entire form to ensure that all the required information has been entered correctly.

08

If applicable, attach any required supporting documents or schedules to the form before submitting it to the appropriate tax authority.

09

Keep a copy of the completed form and all supporting documents for your records.

Who Needs Form 84ag Refund Table:

01

Individuals who have overpaid their taxes and are eligible for a refund may need to fill out Form 84ag refund table to calculate and claim their refund amount.

02

Taxpayers who have experienced significant changes in their financial situation throughout the tax year, such as a change in income, deductions, or exemptions, may also need to use this form to accurately calculate their refund.

03

Additionally, individuals who have made estimated tax payments or have certain tax credits that can be applied towards their refund may need to use Form 84ag refund table to determine their eligible refund amount.

Fill

form

: Try Risk Free

People Also Ask about

Is there a new gas tax in Illinois for 2023?

Between July 1, 2022, and December 31, 2022, the State Motor Fuel tax rate remained at $0.392 per gallon of gasoline and $0.467 per gallon of diesel fuel. Effective January 1, 2023, through June 30, 2023, the State Motor Fuel Tax will be $0.423 per gallon of gasoline and $0.498 per gallon of diesel fuel.

What is a 84AG form in Nebraska?

Any person requesting a refund of Nebraska motor fuels tax paid on fuel used in unlicensed equipment for farming or ranching purposes may file a Nebraska Ag Use Motor Fuels Tax Refund Claim, Form 84AG. Prior to adjustments, the tax paid on the eligible fuel must be at least $25.

What is the fuel tax in Illinois?

Motor Fuel Use Tax From July 1, 2022, through December 31, 2022, the rates are as follows: gasoline/gasohol – $0.559 per gallon. diesel fuel – $0.627 per gallon.

What is the gas tax in NC?

The state income tax rate for 2022 is 4.99%. That drops to 4.75% for 2023, and the plan is to keep enacting small cuts until the rate hits 3.99% in 2027. It's a flat rate, so everyone who owes state income taxes pays on the same rate, regardless of income. The state gas tax now is 38.5 cents a gallon.

What is the gas tax in Oregon?

Oregon State Fuel Taxes Gasoline $0.38 per gallon. Aviation Gasoline $0.11 per gallon. Jet Fuel $0.03 per gallon.

What is the new gas tax in Illinois?

The increase in the gas tax is scheduled each year for July and is tied to annual inflation calculated by the Department of Labor. The Consumer Price Index for 2022 was 8.2%, making for an increase of approximately 3.1 cents per gallon and 42.4 cents per gallon overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 84ag refund table?

Form 84AG refund table is a table that provides information on the refund amounts available to Australian primary producers for the fuel tax credits they claim on their business activity statements (BAS). The table is used to calculate the amount of refund applicable to different types of fuel used in primary production activities, such as using fuel in a farm vehicle or machinery. It helps primary producers determine their eligibility for claiming fuel tax credits and the specific refund amounts they can receive.

Who is required to file form 84ag refund table?

Form 84A is related to filing for a refund of excess contributions made to certain registered retirement savings plans (RRSPs), pooled registered pension plans (PRPPs), and specified pension plans (SPPs). As such, individuals who have made excess contributions to their RRSPs, PRPPs, or SPPs are required to file Form 84A to claim a refund of those excess contributions.

How to fill out form 84ag refund table?

Form 84AG is a refund table used for reporting refundable credits. Depending on the jurisdiction and type of refund, the process may differ slightly. However, here is a general step-by-step guide on how to fill out the Form 84AG refund table:

1. Start by downloading the Form 84AG from the appropriate tax authority's website.

2. Read the instructions and understand the specific requirements for your situation. Make sure you have all the necessary documents and information handy, such as your tax return and any supporting documents related to the refundable credit.

3. Locate the refund table section on the form. It is usually found towards the end of the form, and it may have multiple sections depending on the type of credits being claimed.

4. Review the refundable credits you are eligible for and find the corresponding section in the refund table.

5. Carefully read the instructions provided for each credit and ensure that you meet all the criteria for claiming the refund.

6. Fill in the required information in the refund table, including the credit name or code, the amount eligible for refund, and any other specified details such as tax year or specific refundable amount formulas.

7. Calculate the total refundable amount by adding up all the refundable credits in the table.

8. Double-check your calculations and ensure that you have accurately entered the information. Mistakes or inaccuracies may lead to delays in receiving your refund.

9. Once you have completed the refund table, review the entire Form 84AG for any additional information or signatures required.

10. Attach any supporting documents as instructed, such as copies of receipts or documents verifying your eligibility for each refundable credit.

11. Submit the completed form and any attachments according to the designated submission method provided by the tax authority. This may include mailing the form or electronically submitting it through an online portal.

12. Keep a copy of the completed Form 84AG and any supporting documents for your records.

Note: The specific steps may vary depending on the tax authority or the type of refundable credits being claimed. It is important to carefully read and follow the instructions provided with the form for accurate completion.

What is the purpose of form 84ag refund table?

I couldn't find specific information about a form called "84ag refund table." It could be a form specific to a certain jurisdiction or organization. It's recommended to seek clarification from the relevant authority or organization that issued or requires the form for accurate information about its purpose and usage.

What information must be reported on form 84ag refund table?

Form 84ag is not a recognized tax form. It is possible that you may have made a typographical error or referring to a form specific to a particular country, state, or organization.

To provide an accurate answer, please provide the correct form number and the jurisdiction it is related to.

How can I manage my form 84ag refund table directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 84ag refund table and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out form 84ag refund table using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form 84ag refund table and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit form 84ag refund table on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form 84ag refund table on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your form 84ag refund table online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 84ag Refund Table is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.